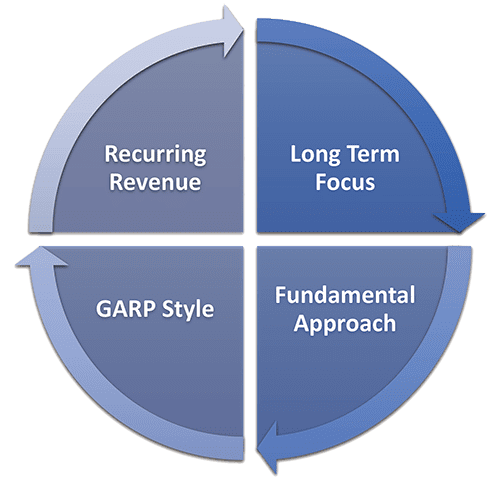

Our Equity Philosophy

Long-Term Focus

Generating superior long-term returns requires investing in companies that do well in bull markets but also can better withstand economic downturns.

Fundamental Approach

Invest in our highest conviction ideas utilizing a rigorous investment process focusing on strong growth prospects and healthy balance sheets.

GARP Style

Buy growth companies at attractive valuations and take advantage of temporarily mispriced names relative to the company’s long-term outlook.

Recurring Revenue

Focus on companies with recurring revenue business models, which we define as having products and services that are utilized within a two-year period of time.

Our Fixed Income Philosophy

Long-Term Focus/Capital Preservation

Designed for conservative investors, AMI fixed-income portfolios are constructed for capital preservation and predictable cash flow. We believe that fixed-income holdings should provide dependable safety and liquidity in down markets.

Fundamental Approach

All fixed-income holdings are selected utilizing a consistent bottom-up process to identify strong credits and improve balance sheets. We test every bond in a downside scenario to understand our margin of safety.

Easy to Understand

AMI fixed-income portfolios are built with easy-to-understand traditional bonds. We never use leverage, derivatives, collateralized products, or leveraged loans.

Nimble

Our size allows us to get meaningful exposure to small and overlooked securities compared to our larger peers. These securities are often mispriced and offer more attractive yields than larger issuers.

Simplifying the Path Towards a Secure Future

As your financial partner, our mission is to provide you with the information you need to make the choices that matter most in your life.