The Skinny on Weight Loss Drugs and the Food Industry

The phenomenal growth of GLP-1s, or weight loss drugs, has been a remarkable success story over the past year or so, driving significant gains for the main firms behind these drugs, Eli Lilly (LLY, an AMI Large Cap growth holding), with its Zepbound/Mounjaro and Novo Nordisk, Ozempic/Wegovy. In August 2023, when initial Novo data on X came out, Food stocks (as well as medical device manufacturers) came under pressure, as investors worried that the rapid growth of GLPs would quickly become a headwind for sales. In this piece we discuss how these drugs work, the early feedback on how they’re impacting consumption, and the risk and opportunities for Staples companies.

GLPs are the most efficacious diabetes/weight loss drugs on the market and offer a trifecta of health benefits (lower A1c, significant weight loss, no low blood sugar risk) and are thus the fastest growing drugs in a growing category that still has a large untreated population. While dieting has been around forever, diets require willpower, and GLPs make people want to eat and drink less. GLPs slow gastric emptying, meaning food stays in your stomach longer, so people really cannot overeat without severe consequences. With a massive addressable market and clear efficacy, there are many who believe that GLPs could become the highest-selling drugs of all time.

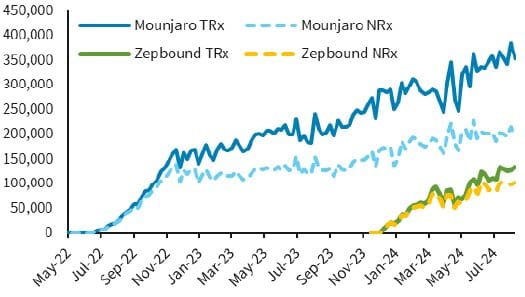

Source: Barclays, National Prescription Audit, January 2021-August 2024

The U.S. has the highest obesity rates globally at 30-40% of adults. There are a little more than 7MM people in the U.S. on a GLP as of August 2024, slightly more than 2% of the total population. People that are obese eat the most and are likely 50% of food consumption. Morgan Stanley analysts have estimated the drugs can drive a 1.5-2.5% decline in total U.S. calorie consumption by 2035, based on the drugs penetrating 9% of the U.S. population. Numerator survey data from earlier this year showed that grocery spending of GLP-1 users decreased 6-9% after starting on the drugs. Much of how the penetration of the drugs evolves will be dependent on insurance coverage and cost, which is outside of the scope of this piece. There is also significant uncertainty around how long users need to stay on the drugs and what happens when they eventually do come off.

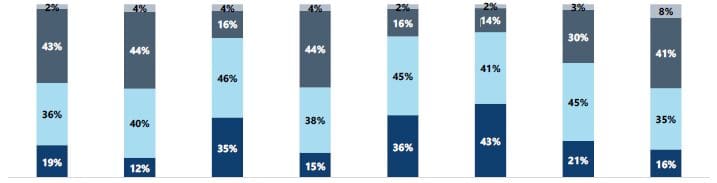

What is most interesting and relevant is that the impact from the drugs on consumption is likely to be very uneven across Food and Beverage categories. A Jefferies survey indicates consumers on the drugs are cutting back most on products with high carbohydrate content, specifically sweets, salty snacks and sugary drinks, while increasing consumption of high protein foods like protein bars and shakes. The drugs make these high-carb products, that many of them almost certainly used to love, not just unappealing but almost sickening to GLP patients.

Changes in Food Consumption by Category

Source: Jefferies proprietary survey, September 2023

The underlying question is how companies will respond. Will we start seeing a company like Frito-Lay (owned by PepsiCo (PEP), an AMI Large Cap growth holding) offering cucumber chips instead of Doritos? No, but there are options, including smaller portion sizes, less sodium and more fiber, which would help with some of the digestive side effects of the drugs. Pepsi has also been building out its healthier beverage options, and the company’s sizable exposure to emerging markets should help offset any slowdown in growth in the U.S. In addition, Pepsi’s balance sheet should help it augment growth with M&A. We view VitaCoco (COCO, an AMI Small Cap growth holding) as a perfect fit for Pepsi, as demand for hydration grows rapidly, especially among younger generations.

McCormick (MKC), the global spices & seasonings leader and AMI Large Cap growth holding, is in a unique position to see some benefit from these consumption shifts, in our view. As consumers move towards healthier, fresher food, they still want food to taste good. There’s no better way to spice up a cauliflower steak than with Frank’s Red Hot or Cholula.

Diversified retailers, especially businesses like Walmart and Costco (COST, an AMI Large Cap growth holding) are likely to be more insulated from shifts in consumption. Groceries are only 50% of Costco’s sales, and the retailer also has a large pharmacy business that should benefit from increased adoption of GLPs. Grocery stores like Kroger and Albertsons are more at risk, and it is no surprise these two companies are trying to merge to increase scale.

GLP users need protein to maintain muscle mass while on the drug, as the weight patients lose is about 50/50 fat and muscle. Protein bar/shake companies like BellRing Brands (BRBR), Coca-Cola’s (KO) Fairlife and Simply Good Foods (SMPL, an AMI Small Cap growth holding) have already released products specifically designed for GLP users. However, most of these products are thick with sweet flavors like chocolate or strawberry. Mattson’s research showed that a more hydrating, lighter citrus flavored protein drink was much better received by GLP users, suggesting these companies have some work to do to capture the potential upside.

We are cautious about the prospects for producers of salty snacks and sweet treats, particularly those whose business is heavily concentrated in the U.S. Using this framework we see Hershey (HSY) as likely the most exposed to sales headwinds from GLPs, but these are unlikely to be meaningful until the end of this decade.

The growth of GLPs is likely not an existential threat to even the most exposed Food company, at least not for the next few years. Management teams have consistently said that they’ve seen no impact from the drugs on their businesses to-date. However, after a period of demand for classic products driven by the pandemic, Food companies will need to adapt and innovate to capture consumption shifts moving forward. In the near-term, with the economy weakening, certain Food companies represent excellent investments as very defensive businesses. People still have to eat (even if they’re out of work or on GLPs). We feel very comfortable that the Food positions we own at AMI are best positioned to grow in any economy, offset any headwinds from GLPs and possibly benefit as penetration grows over time.

Important Disclosures

This communication is prepared and distributed by AMI Asset Management (AMI), an SEC registered investment adviser (registration does not imply a certain level of skill or training). The information contained herein, and the opinions expressed are those of AMI as of the date of writing, prepared solely for general informational and discussion purposes. The information contained in this communication has been compiled by AMI from sources believed to be reliable; however, AMI does not make any representation as to their accuracy, completeness or correctness and does not accept liability for any loss arising from the use hereof. Such information and opinions are subject to change without notice due to changes in market or economic conditions and may not necessarily come to pass. References to specific securities are not intended as recommendations of said securities. The reader should not assume that any investments in securities, sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. Past performance is not a guide to future performance and future returns are not guaranteed.

FOR FINANCIAL PROFESSIONAL USE ONLY. NOT TO BE SHOWN OR DISTRIBUTED TO THE PUBLC.