AMI Asset Management’s Macro Notes from the CIO – September 2024

The economy continued to weaken in July and August, and while volatility has increased, the stock market remains near an all-time high. This disconnect is puzzling, but there appears to be two investor camps: one that believes the U.S. is heading for a recession and one that believes Federal Reserve rate cuts will avoid a recession. Stock market performance also remains narrow as the ultra-large cap names have held up well; Nvidia being the most extreme example. Regardless of the outcome, we believe there is downside risk to the stock market as it is currently trading near an all-time high P/E multiple. We believe our continued focus on downside mitigation is prudent.

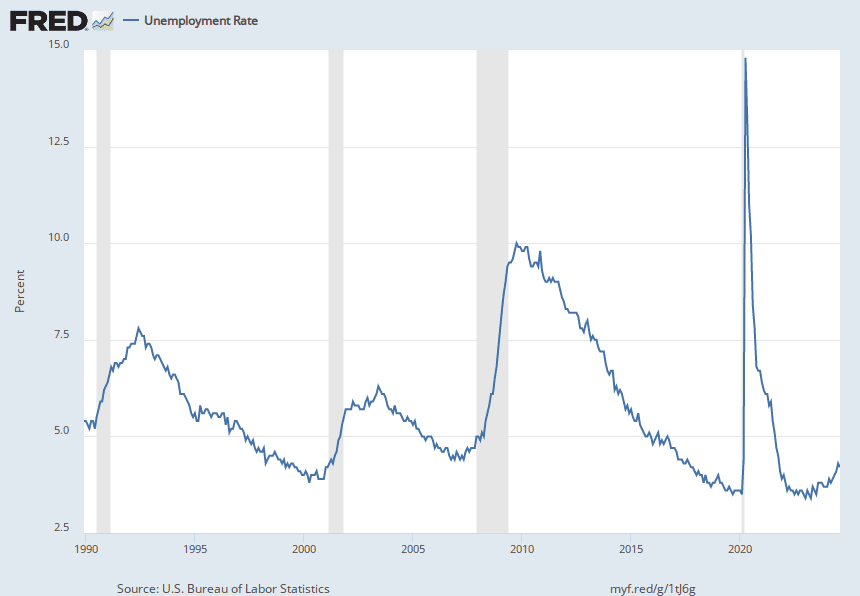

The jobs report for July, announced in early August, kicked off the most recent bout of stock market volatility after coming in at 114K new jobs, well below the 175K estimate and below the 12-month average of 215K. In addition, the prior two months were revised down by 29K. The unemployment rate ticked up to 4.3%, from 4.1% (Chart 1), triggering the Sahm Rule, which contends that the economy is in recession when the unemployment rate rises by 0.50% off the previous 12-month low.

*Source: U.S. Bureau of Labor Statistics, 9/12/ 2024, shaded areas indicate U.S. recession

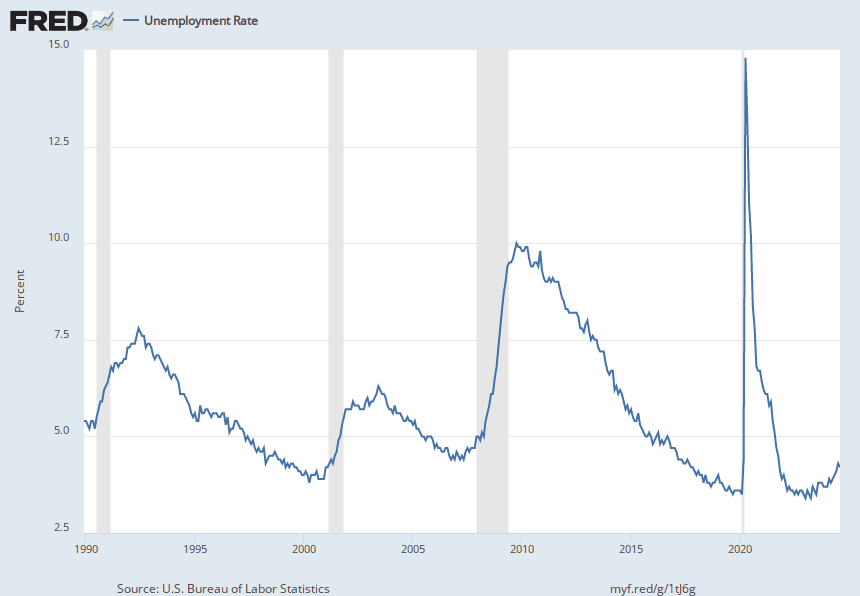

Although the creator, Claudia Sahm, herself has stated that this time might be different, the rule does have a strong track record and is usually a few months late in confirming recessions as seen in Chart 2.

Chart 2

*Source: Sahm, Claudia, 9/12/ 2024, shaded areas indicate U.S. recession

The market calmed down after the first week in August, but volatility again rose in early September following another jobs shortfall. For August, 142K jobs were added, missing the 165K estimate and below the 12-month average of 202K. In addition, the prior two months were revised lower by a combined 86K jobs. The Bureau of Labor Statistics (BLS) jobs survey has become less reliable due to a low survey response rate, meaning the revisions are becoming more important and the true labor picture doesn’t come in vision until much later. For example, the BLS annual revision removed 818K jobs from March 2023-March 2024 and won’t be finalized until 2025. Unemployment is a key indicator for the Fed. Notably, it tends to be either going up or down, rather than staying level, and it is currently on the rise.

Other economic metrics also remain weak. ISM Manufacturing has been in contraction for nearly two years and ISM Services continues to teeter just above the contraction mark. Auto Sales, Auto and Credit Card Delinquencies, and Residential Construction have also weakened as of late. Commercial Real Estate is in a uniquely challenging spot due to companies remaining on hybrid work schedules and needing less office space. These loans are coming due and could be a substantial headwind to regional banks that are overweight this asset.

The consumer has so far been one of the bright spots, especially at the high end. Covid-era stimulus has been a big driver of consumer spending over the past few years, but this appears to be waning as the savings rate has fallen sharply and we are now seeing some retailers and restaurants beginning to feel the impact.

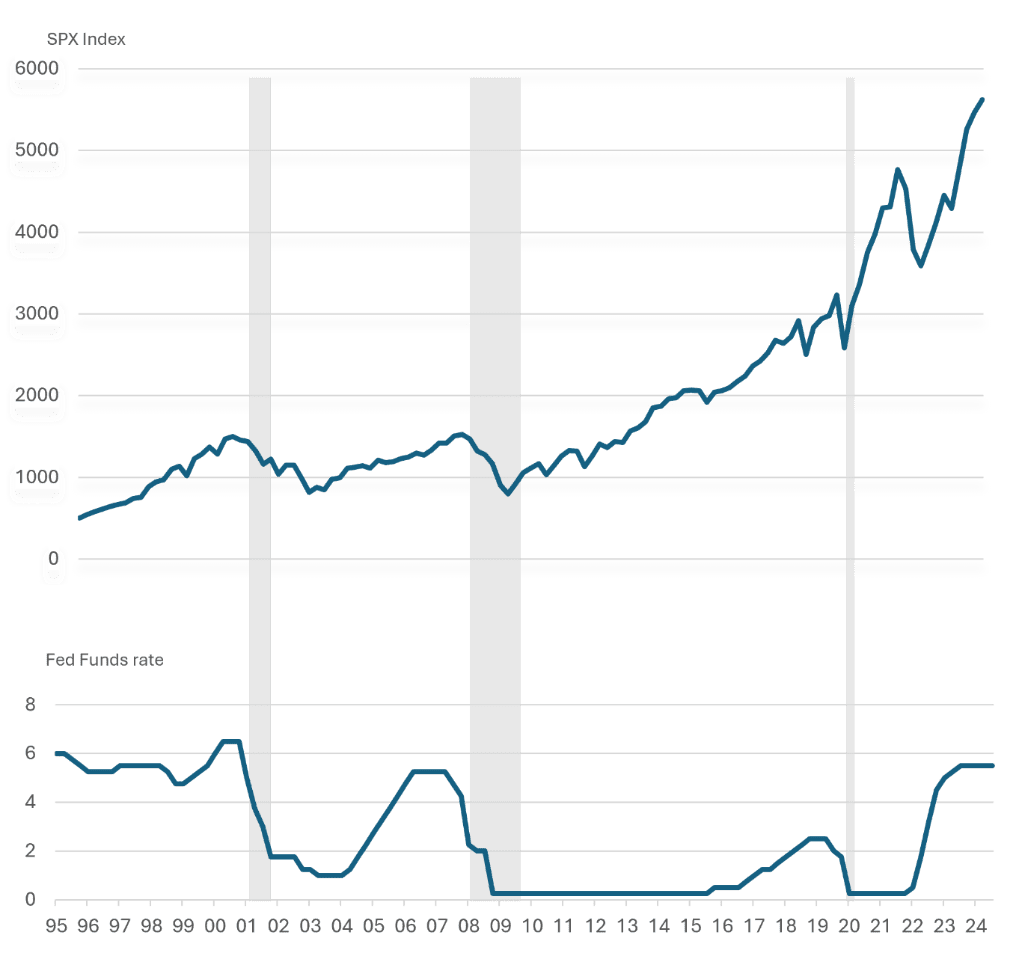

The Fed is widely expected to begin lowering rates this week and the consensus is nearly evenly split between 25 and 50 bps. We believe the Fed is in a tough spot as a 25bps rate cut is less shocking but does little to nothing for the economy and could lead investors to believe the Fed is behind the curve. However, a 50bps cut would have a more meaningful impact but could spook investors. While the market could cheer a rate cut, historically, rapid Fed cuts have coincided with downside in the stock market, as seen in Chart 3 below.

*Source: Bloomberg, 9/12/2024, shaded areas indicate U.S. recession

With the stock market at an all-time high and still narrowly-driven by ultra-large Tech names, we remain cautious and have been derisking the portfolio this year by trimming fully valued names and shifting to names we believe are less cyclical. The Fed does not have a good track record of engineering soft landings; therefore, we believe our core philosophy of focusing on recurring revenue business models is especially prudent in this environment.

Important Disclosures

This communication is prepared and distributed by AMI Asset Management (AMI), an SEC registered investment adviser (registration does not imply a certain level of skill or training). The information contained herein, and the opinions expressed are those of AMI as of the date of writing, prepared solely for general informational and discussion purposes. The information contained in this communication has been compiled by AMI from sources believed to be reliable; however, AMI does not make any representation as to their accuracy, completeness or correctness and does not accept liability for any loss arising from the use hereof. Such information and opinions are subject to change without notice due to changes in market or economic conditions and may not necessarily come to pass. References to specific securities are not intended as recommendations of said securities. The reader should not assume that any investments in securities, sectors and markets identified or described were or will be profitable. Investing entails risks, including possible loss of principal. Past performance is not a guide to future performance and future returns are not guaranteed.