Financial Planning at Your Fingertips

We use a state-of-the-art financial planning tool to help our clients visualize their financial future and make informed decisions about their wealth.

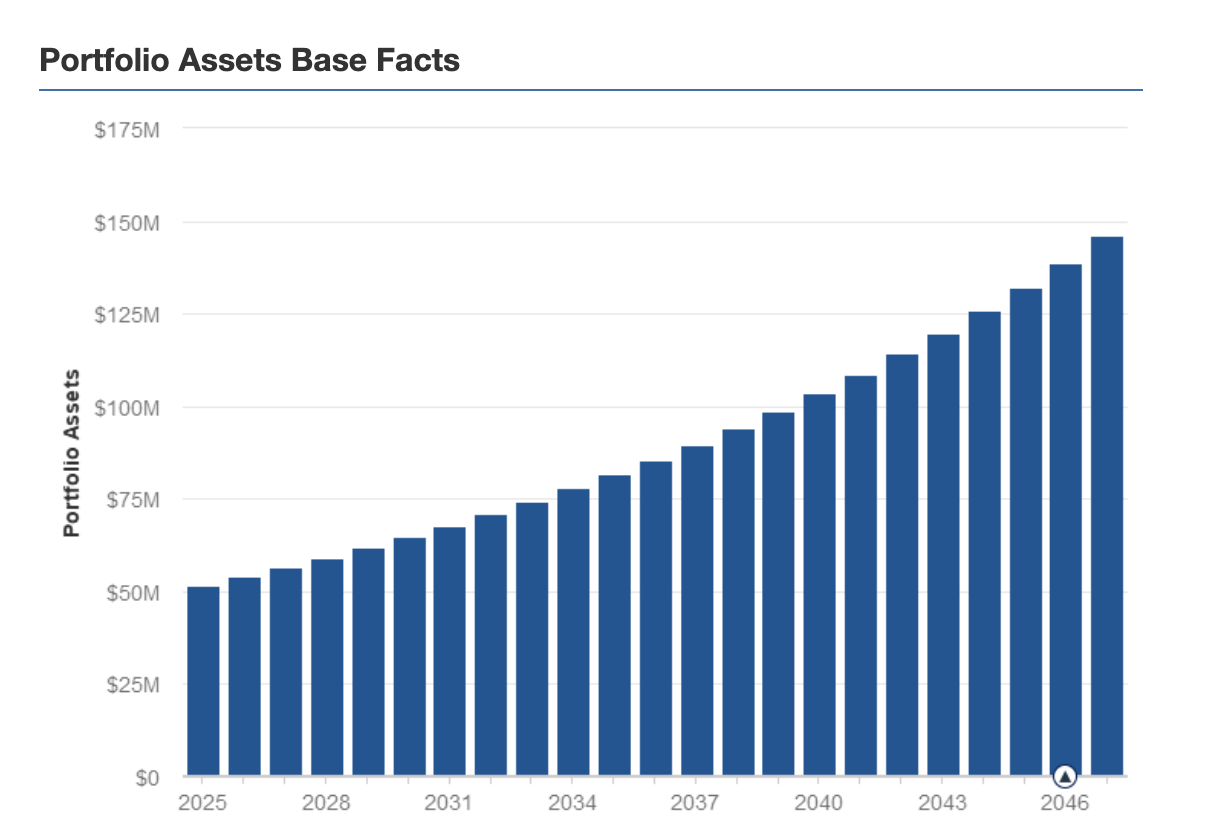

Visualize your assets and progress towards long-term goals.

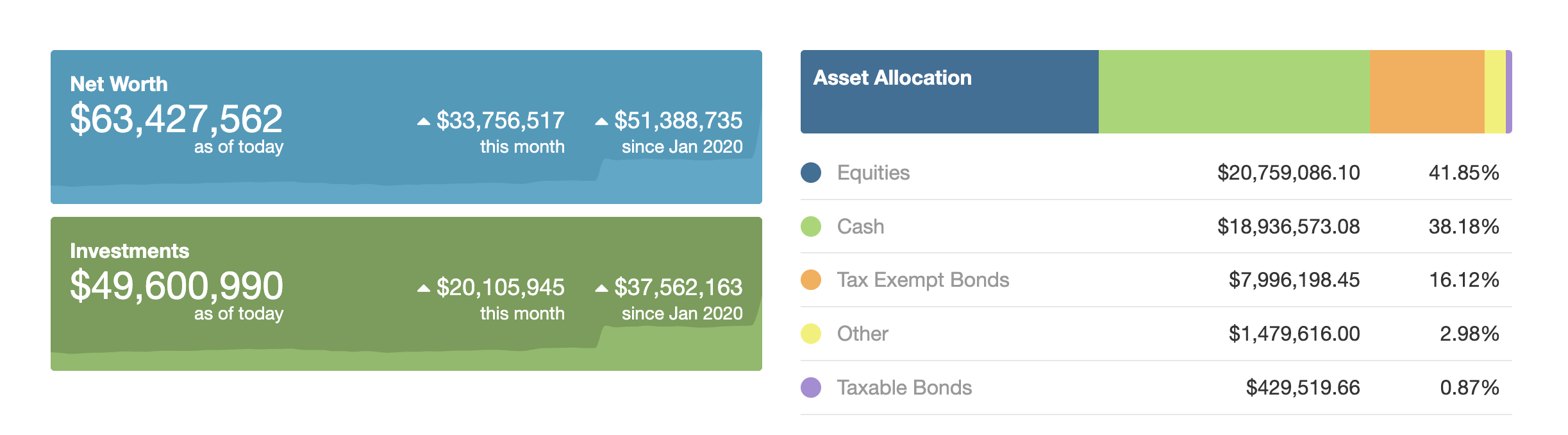

Track your net worth, investments, and asset allocation in real time.

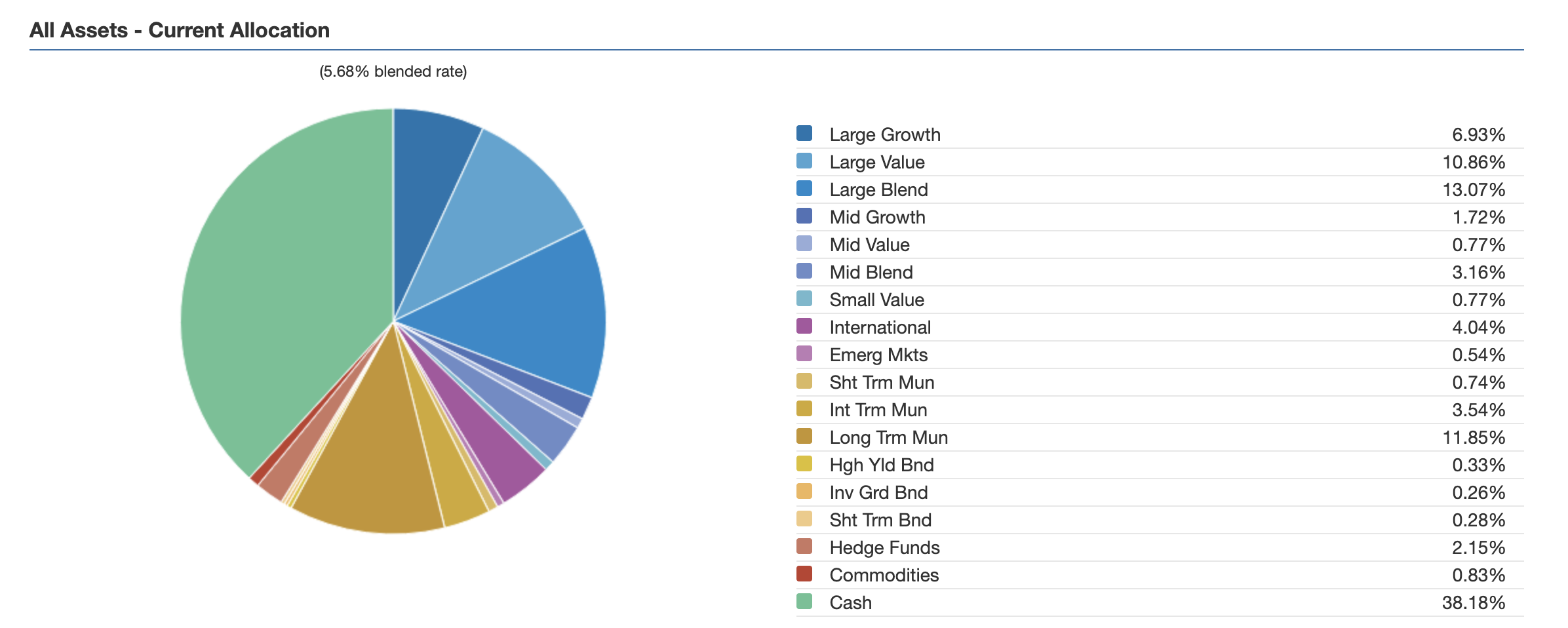

View a detailed breakdown of your current holdings by asset class.

We help you answer questions like:

- What can I retire with?

- Is my spending in line with my objectives?

- Can I afford a new house?